Melamine Monthly Review: Market Weakness (September 2023)

1. Market review of this month

1.1 Analysis of domestic melamine price trend

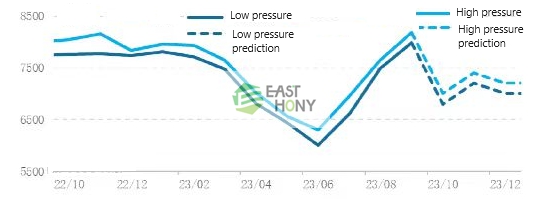

In September, China’s melamine market showed a weak downward trend.

As of September 26, the average factory price of melamine in China this month rose 6.75% from the previous month; It was down 3.19% from the same period last year.

This month, the melamine market rose until reaching the highest point of the year at the beginning of the month, and then gradually oscillating fell down. This month, enterprises stopped production for maintenance and resumed production, and the starting load increased after the first decrease.

On the one hand, the supply and demand side has a large impact on the melamine market, the overall production enthusiasm of downstream factories is not high, with the price falling, the downstream willingness to buy is not high, most of them just need to buy, resulting in manufacturers receiving insufficient orders, the pressure of shipping is increasing, and the National Day holiday is approaching, the willingness to receive orders before the holiday is strong, so manufacturers have to reduce prices to attract orders, but with little effect.

On the other hand, at the cost side, the price increase of raw material urea market continues to weaken, although urea prices continue to be high this month, but the influence of melamine market is decreasing, further aggravating the wait-and-see mood on the floor. With the downward trend of market weakness and the lack of confidence of market participants, the space for transaction prices to be negotiated has further expanded.

From the perspective of raw materials, urea still has a downward space after the holiday. Due to the increase in supply and the decrease in demand, the supply and demand pattern will tend to be relaxed, the downward pressure on the market still exists, and the increase in the cost of melamine will continue to weaken; With the continuous decline in prices, some commercial reserves in the late winter will increase moderately, which may form a certain pull on the market.

From the supply side, although individual enterprises have maintenance plans in October, the overall operation of other enterprises is relatively stable, and there are new equipment production plans, and the supply increment is more obvious.

From the demand side, with the appropriate decline in raw material prices, after the holiday, some downstream factories are expected to increase the operating rate, may be appropriate replenishment, but because there are still many variables in the future market, market confidence is insufficient, and the purchase volume is relatively limited.

Before the holiday, the downstream goods will not be high, most manufacturers receive orders are not smooth, and with the continuous improvement of the operating rate, some inventory will increase; In addition, the price of urea continues to decline, so it is inferred that there is still some downward pressure on the short-term domestic melamine market, until the price falls to a narrow range near the cost line.

Remark: The analysis is based on transaction in China’s domestic market, it’s only for reference.

Contact information: melamine@easthony.com